OPA: Realtor-cop was dishonest, broke law in a failed real estate venture with his wife

Officer Olivier Rigon is likely facing termination after he and his wife misspent loaned funds and "fraudulently" failed to report assets to a federal bankruptcy court.

Seattle police Officer Olivier Rigon violated the law when he misappropriated funds loaned to the struggling real estate business he ran with his wife and submitted false financial statements to a federal bankruptcy court, the Office of Police Accountability found at the end of June. Though Chief Shon Barnes hasn’t issued final discipline, similar findings have historically ended in termination.

Former KIRO Radio host Ron Upshaw filed the complaint in 2022. Upshaw met Rigon through a real estate course and loaned his wife $30,000 in 2019 to remodel and flip a property. But after nearly three years, Rigon and his wife, Christine Kwon, had not repaid a cent or made any improvements to the home.

When Upshaw emailed Rigon about repayment in 2020, Rigon deflected, citing “financial trouble” related to the “2020 pandemic and SPD Defunding movement,” according to a police report.

Upshaw hired an attorney to draft a repayment plan that Kwon and Rigon initially agreed to, but he filed a lawsuit when they did not pay. In February 2021, Kwon and Rigon filed for Chapter 7 bankruptcy, seeking to discharge the debts of their property company, Rock PI, LLC.

Through his lawsuit, Upshaw discovered several irregularities in the couple’s bookkeeping. For starters, Upshaw’s $30,000 loan was listed on Rock PI’s ledgers as rental income. Also, Upshaw determined that Rock PI had raised $190,000 from various sources for the same renovation project, but the purported budget was only $90,000.

Their intent, Upshaw claimed, was to take out several large loans from acquaintances, misappropriate the loaned funds, file for bankruptcy, and never repay.

In court filings, Rock PI’s other creditors made nearly identical claims. For example, Kelly Milbrandt loaned Rock PI $50,000 to add a detached accessory dwelling unit to a house in Madrona and flip it for $1.5 million. But the improvements never materialized. Kwon and Rigon could not produce records to show how the money was spent, and it was apparently used to pay down Rock PI’s debts, according to court documents.

The Road to Bankruptcy

Rigon would almost certainly not be a Seattle police officer if his real estate career had taken off. Rigon and his wife joined the house-flipping craze amid a booming Seattle area real estate market in the mid-2010s.

According to court documents, Kwon moonlighted as a real estate agent while working as a data engineer at Amazon. She set up Rock PI in 2015 and was in total control of its finances. Rigon worked exclusively for the company as a project manager from its founding until 2020, when the Seattle Police Department hired him.

Rock PI turned a profit in its first three years, prompting Kwon to quit Amazon in 2018 to work on the real eastate business full-time. When the business began faltering a year later, Kwon went back to work while Rigon prepared to apply to SPD by taking the police exam and getting his GED.

During this period, Kwon began taking loans for new projects, including the ones from Upshaw and Milbrandt, and the line between couple’s personal finances and ledgers of Rock PI became increasingly blurry. Property was purchased through the company but the rents and the proceeds of the sales went directly into the couple’s personal bank accounts.

‘Knowingly and fraudulently’

Though the loans predate Rigon’s time at SPD and Kwon was in charge of the company’s finances, he is still subject to discipline for any dishonest statements and violations of the law during the couple’s Chapter 7 bankruptcy petition.

The courts found several.

Under penalty of perjury, Kwon and Rigon submitted financial statements with their bankruptcy petition, swearing under oath that they were complete and correct. They were anything but. The two didn’t disclose property sales, rental income, bank accounts or transfers to and from a trust account.

In October 2023, the bankruptcy court held a trail that resulted in the denial of their petition to discharge their debts under Chapter 7. Rigon appealed his denial separately. Incredibly, he claimed that he signed the financial statments without looking at them or verifying their accuracy.

The appeals court affirmed the lower court’s ruling in November 2024, quoting the original decision’s language that Rigon “feigned ignorance” and that both showed a “pattern of willful ignorance of their assets and liabilities.”

Another Open Case

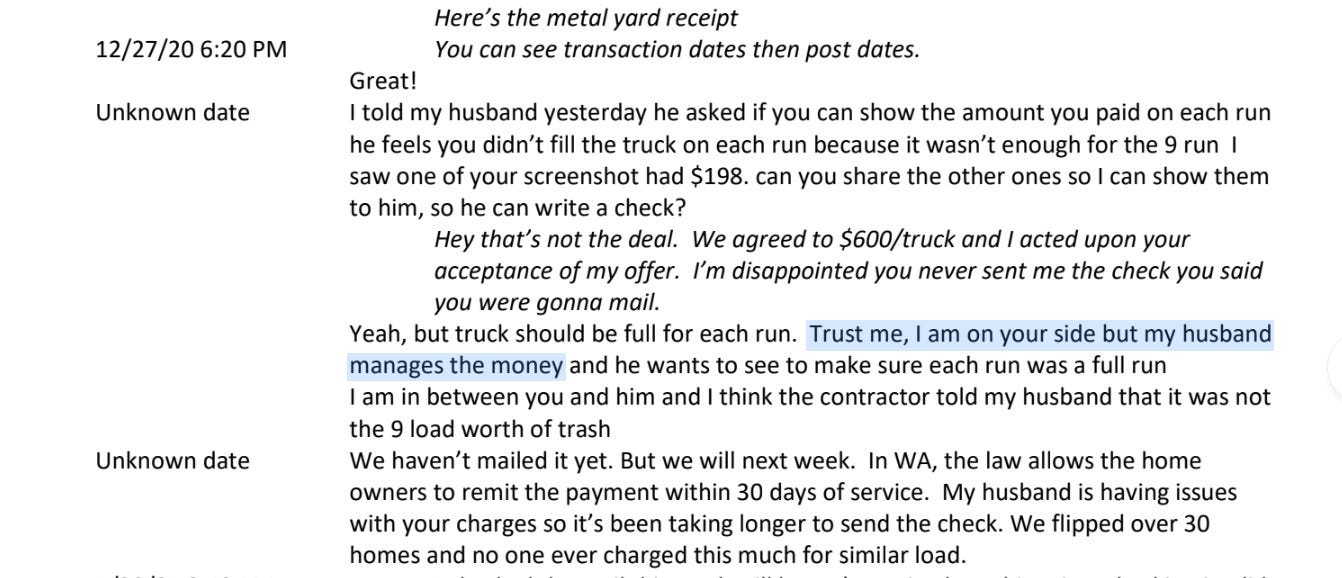

Rigon and Kwon played a similar game in another incident that is the subject of a still-open OPA case from 2022. It also stems from their failed real estate business. A junk hauler accused Rigon of stiffing him for removing construction waste at a property that was being foreclosed in Madrona.

Operating under the assumed name “Dean Riggs,” Rigon disputed the charge for services, arguing that the junk hauler did not haul full loads. He told OPA investigators that he hadn’t been involved with the business since he joined the department, but the contractor said that he appeared at the job site, and Kwon wrote in a text that Rigon “manages the money.”

The contractor attempted to recover his $5,500 payment through small claims court but was blocked by Rigon’s bankruptcy proceedings.

Rigon deflected, citing “financial trouble” related to the “2020 pandemic and SPD Defunding movement,”

Couldn’t roll my eyes harder.